In the last couple of years, I have seen more and more people that are used to receiving a refund and they wound up owing on their tax return. There could be several reasons why you might end up with a balance due. This is a trend across the board and has been addressed in several articles lately. The IRS has also seen a raise in employees owing taxes.

- LA Times https://www.latimes.com/business/story/2022-10-28/irs-growing-gap-between-us-income-taxes-owed-and-paid

- AP Washington News https://apnews.com/article/irs-tax-gap-audits-inflation-reduction-act-e0dcb9bc52cfcdd8fc40caa2c04e8011

- Wallstreet Journal https://www.wsj.com/personal-finance/taxes/who-owes-irs-money-2023-803844a8

- Washington Examiner https://www.msn.com/en-us/money/taxes/irs-audit-report-finds-employees-owe-50-million-in-back-taxes-double-standard/ar-BB1qQdcW?ocid=BingNewsSerp

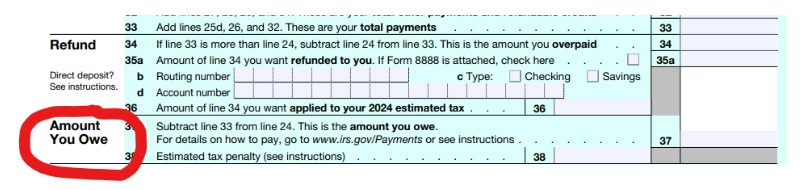

The Wall Street Journal reported on nearly 2 million additional individual taxpayers owed the IRS. The overdue tax balance increased from $308 billion to $316 billion. This increase involves several factors, including but not limited to, the ending of many COVID measures, infrequent notices to pay, and surprise taxes due in April. People that previously received a refund may find that in the future they will end up owing more in taxes.

There are several reasons why this could occur. Life changes like getting married, having a child, or a raise at work. If you work at a W-2 job, your withholding might not be high enough, resulting in owing rather than receiving a refund. This can leave you unable to pay and accrue interest and penalties.

Another factor is a lot of people have picked up side hustles like driving for Uber or Amazon flex. Freelance and gig work do not take taxes out of your pay and you are responsible for the tax payments. You should be aware that you need to pay taxes quarterly, but without that knowledge, you can find yourself short in April.

Until you pay the amount due, the IRS will continue to accrue interest and penalties on your tax liability. Unfortunately, only annual balance-due reminders are sent out by the IRS which is causing taxpayers to compound what they owe and not paying on regularly due to the infrequent reminders.

Do you have concerns about owing taxes and penalties or do you need assistance in completing your W4 form correctly? At Tax Trackers, we would be happy to advise and recommend strategies on how to avoid a balance due on your tax return. Are you unsure if you have used all of your deductions or are you concerned your bookkeeper might have not maximized your expenses? Let us review your tax return and audit your books to make sure you have maximized your tax return. Our team and network are dedicated toward your financial growth because we know, “Your Success is Our Success”

Until next time,

Florence Hicks, Owner of Tax Trackers Inc