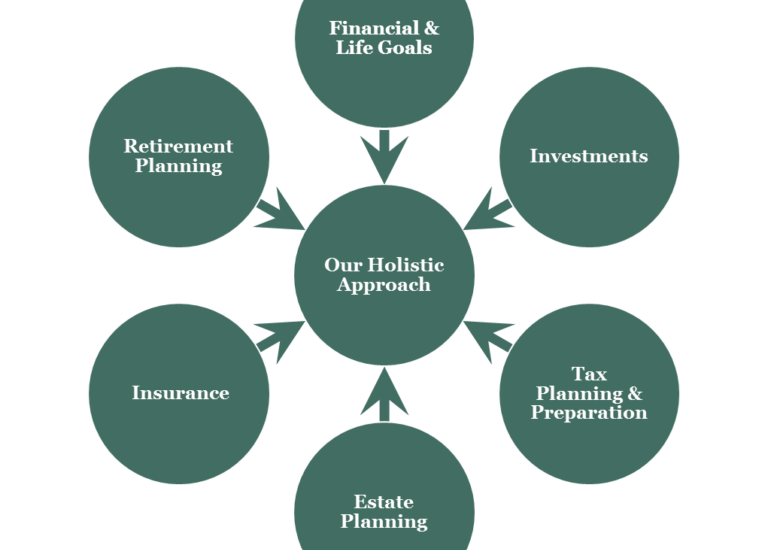

“All areas of your finances work together. If your financial team doesn’t, maybe it’s time to consider a change”

If you have never heard of a Holistic Financial System, that could be because most people have never heard of such a concept. What does it even mean?

There are just a few major components in your finances. Whether you know it or not they are all working in conjunction with each other while you work, play, eat and sleep. The First Step is to understand, WHAT are these MAJOR financial components?

FORBES: How A Holistic Approach Can Help You Take Control Of Your Money (forbes.com)

That is what I will cover in this month’s BLOG:

INCOME: You would be surprised to know how many people do not know their salary or hourly rate on an annual basis. This is because most Americans know what they “Take home” from each paycheck and that is all that matters to them. Understanding your salary helps you understand how much is actually being taken out of your check for taxes and benefits. If you are going to have financial success you must, Know Your Numbers.

CREDIT: Most people only think of credit when they need to use it. The best time to think of credit is for the rest of your life! Because that is how long you have it… It’s time there was a credit education revolution in this country. The United States Citizen has the greatest borrowing power than any citizen, of any other country. With the right education and application of credit, GREAT things can happen.

Credit Services – Credit Connections (creditconnectionsinc.com)

DEBT– When taking a look a debt most Americans either want to stay out of it or eliminate it, and they stay stuck in that cycle for the rest of their life. Understanding how debt can work for you, is a great way to tackle paying off the BAD DEBT that you have and accumulating the GOOD DEBT that help you achieve a life most only dream of.

Debt Payoff – Credit Connections (creditconnectionsinc.com)

TAXES – The tax code is so elaborate that most people stick their heads in the sand when it comes to learning about their taxes. For those that do the opposite, they can see how generous the tax code is. Understanding how homebased businesses work, paying taxes as a business owner, and the deduction progress for your business, could save you hundreds of thousands over your lifetime, if not millions.

Bookkeeping & Tax Preparation – Credit Connections (creditconnectionsinc.com)

RETIREMENT – Putting the cart before the horse comes to mind when I hear so many people talk about retirement. ARE your credit, debt and taxes in line? If not, the chances of you retiring NO matter how much retirement you save are slim. The reason for that is credit, debt and taxes are ALL liabilities that we will have for the REST of our lives. If any of those three things are not in good shape, them retirement will have to be liquidated at an increased tax rate to eliminate the liability that has come up. Knowing when to seek out a retirement professional and WHAT products of theirs you should start with is where everyone should start in their retirement journey.

Retirement Planning – Credit Connections (creditconnectionsinc.com)

With all that being said: Most financial institutions will work on one of these areas but not all of them at the same time. Knowingly or not, this will cost you time, money and future opportunities.

At Credit Connections Inc, we pride ourselves on working on all areas of your finances at once, working with other professionals to hit your targeted goals, and watching your finances prosper with our holistic financial programs.

Our team and network is dedicated towards your financial growth because we know, “Your Success is Our Success.”